![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

U.S. Imposes 25% Tariff on Steel and Aluminum Imports: Policy Breakdown and Strategic Solutions

Policy Overview

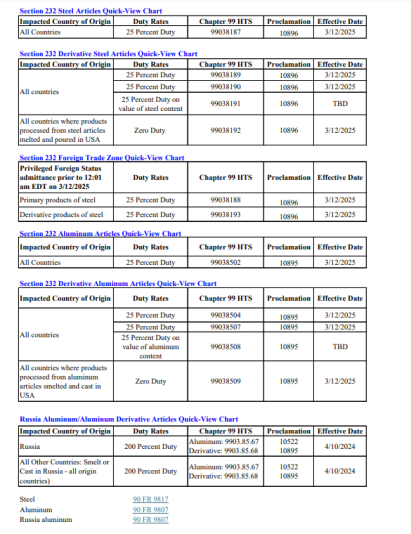

The U.S. Customs and Border Protection (CBP) has released updated guidelines for implementing new tariffs on steel, aluminum, and their derivatives. Effective March 12, 2025, 12:01 AM EDT, all imports of these products into the U.S. will face a 25% tariff. Key highlights include:

→ Compounded Tariff Burden for China: Combined with existing Section 232 (25%), Section 301 (25%), and the new 2025 tariffs (20%), Chinese steel exports to the U.S. now face a 70% comprehensive tariff rate.

→ Expanded Derivative Coverage: Includes industrial goods containing steel/aluminum (e.g., automobiles, solar mounts). Products must undergo smelting and casting in the country of origin to avoid high tariffs.

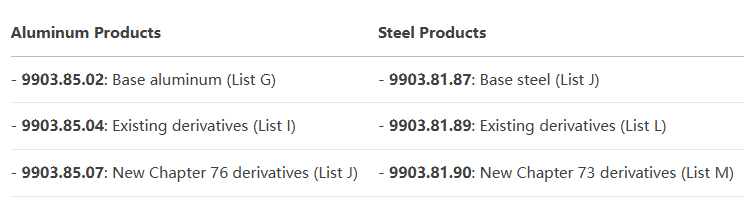

Key Tariff Categories

Differentiated Tax Clauses:

• Non-exempt derivatives: Taxed on material value (full product value if unknown).

• U.S.-sourced materials: 0% tariff on material value for overseas processed derivatives.

• Russian products: 200% punitive tariffs (e.g., 9903.85.67/69 for aluminum).

Key Impacts on Industries

1. Supply Chain Cost Escalation

• Raw Material Inflation:

▫ U.S. domestic steel/aluminum prices surge, impacting downstream sectors (automotive, construction).

▫ Example: Truck manufacturing costs rise by $35,000 per unit; housing prices may increase 5-8%.

• Supply Chain Restructuring:

▫ Shift to domestic suppliers (e.g., U.S. Steel’s capacity utilization to exceed 85%).

▫ Complex rerouting through third countries.

2. Macroeconomic Ripple Effects

• Inflation Pressure: Household disposable income could drop by 930–1,200 annually; core CPI may rise 0.3–0.5%.

• Manufacturing Slowdown: PMI risks falling below 50 (contraction territory) in Q2–Q3 2025.

• Investment Paralysis: Heavy truck orders down 38% YoY; capital expenditure cuts of 15–20% in steel-intensive sectors.

3. Global Trade Disruptions

• Retaliation Risks: Canada may impose tariffs on U.S. agriculture; EU could target bourbon and motorcycles.

• USMCA Undermined: Nearshoring momentum stalls; North American manufacturing synergy declines.

• Emerging Markets at Risk: Export-dependent economies (e.g., Brazil, Ukraine) face currency and debt crises.

Strategic Recommendations for Enterprises

Immediate Actions

⒈ Supply Chain Audit: Prioritize AEO-certified firms for expedited clearance.

⒉ Tariff Mitigation:

• Leverage FTZ privileges for pre-March 12 imports.

• Explore U.S.-sourced material exemptions (e.g., 9903.81.92 for steel).

⒊ Compliance Monitoring: Track updates to derivative lists in the Federal Register.

Long-Term Resilience

• Diversified Sourcing: Partner with tariff-exempt countries (e.g., India, Vietnam).

• Material Innovation: Invest in alternative alloys and lightweight composites.

• Policy Advocacy: Engage in product exclusion requests and trade negotiations.

Proven Strategies to Navigate Tariff Turbulence

In an era of escalating trade volatility, Shengshi Group Global Logistics delivers tailored solutions to mitigate tariff impacts and secure competitive advantages:

⒈ Supply Chain Optimization:

• Conduct end-to-end audits to identify cost leaks and compliance gaps.

• Deploy FTZ strategies to defer or reduce tariff liabilities.

⒉ Customs Excellence:

• Accelerate clearance via AEO partnerships and pre-classification services.

• Ensure seamless compliance with CBP’s HTS code requirements.

⒊ Cost Containment:

• Negotiate preferential logistics rates with tariff-adjusted routing.

• Implement duty drawback programs for eligible exports.

Why Choose Shengshi?

• End-to-End Expertise: From tariff classification to bonded warehousing.

• Agility in Crisis: Real-time monitoring of policy shifts and retaliation risks.

• Profitability Focus: Reduce landed costs by 12–18% through strategic sourcing.