![[sort:pic]](/template/default/images/banner/3-3.jpg)

Lean management provides customers with high-quality services and a visible panoramic view of the prosperous era.

Share

Breaking: Trump Unveils New Tariff Wave — Up to 100% Duties on Heavy Trucks, Furniture, Pharmaceuticals & More

Overview

1.Sept. 25 (U.S. time): Trump announced that beginning Oct. 1, the U.S. will impose a 25% tariff on imported heavy-duty trucks; 50% on kitchen cabinets, bathroom vanities, and related building materials; 30% on imported furniture; and 100% on branded and patented pharmaceuticals.

2.Sept. 24: The U.S. Commerce Department confirmed it launched Section 232 investigations on Sept. 2 covering imported robots, industrial machinery, PPE, medical consumables, and medical devices.

3.Sept. 24: The U.S. will reduce tariffs on EU-made automobiles to 15%, retroactive to Aug. 1, under the summer trade framework agreement.

4.Sept. 24: U.S. Customs and Border Protection (CBP) issued a Withhold Release Order (WRO) on Taiwan-made Giant bicycles and components due to forced labor indicators.

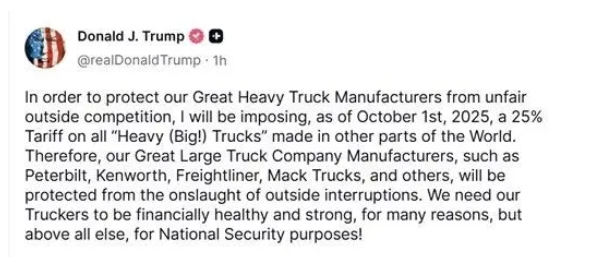

Trump Announces New Tariffs on Multiple Import Categories

On Thursday, Sept. 25, President Trump released three consecutive posts on Truth Social announcing a broad new tariff package.

(1) 25% Tariff on Imported Heavy-Duty Trucks

Trump wrote in his post that the 25% tariff will apply to all imported heavy-duty trucks.

He added that the measure will benefit U.S.-based manufacturers such as Peterbilt, Kenworth, and Freightliner.

A 100% tariff will apply to all branded or patented imported drugs unless the pharmaceutical company is actively building a manufacturing facility in the United States.

Trump stated:

“Beginning October 1, 2025, we will impose a 100% tariff on any branded or patented pharmaceutical unless a company is BUILDING its pharmaceutical plant in the United States. ‘IS BUILDING’ will be defined as ‘groundbreaking’ and/or ‘under construction.’ If construction has already started, the tariff will not apply.”

(3) 50% tariff on kitchen cabinets and bathroom vanities

(4) 30% tariff on upholstered furniture (e.g., sofas)

Trump explained:

“These products have been flooding into the U.S. from other countries. It is extremely unfair, and for national security and other reasons, we must protect our manufacturing process.”

The top five sources of U.S. truck imports are Mexico, Canada, Japan, Germany, and Finland.

Major pharmaceutical import sources include Ireland, Germany, Switzerland, and India.

Trump confirmed all measures will take effect October 1, 2025.

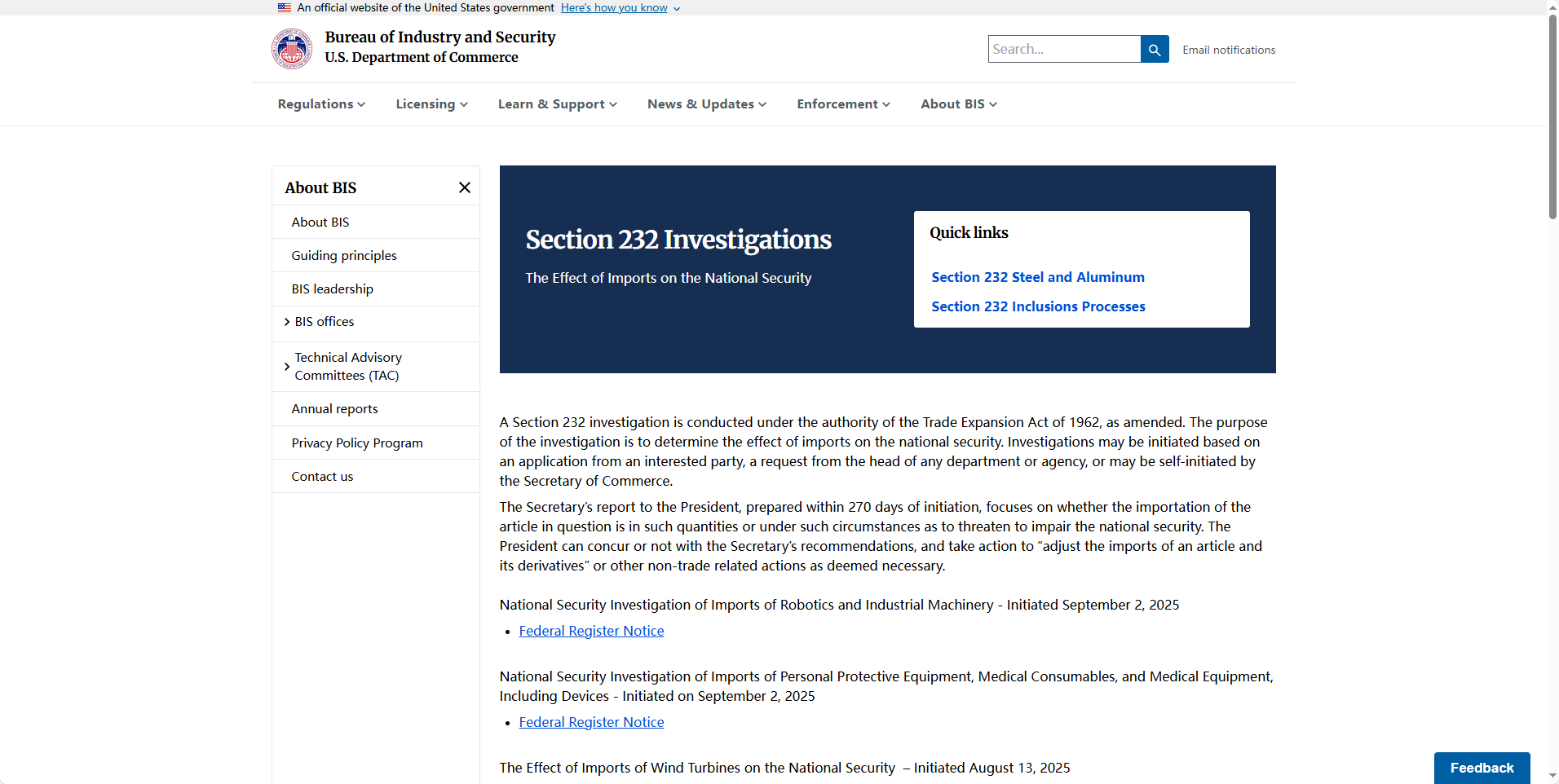

U.S. Commerce Department Launches New Section 232 Investigations

On Sept. 24, the U.S. Commerce Department’s Bureau of Industry and Security released two Federal Register notices confirming that Section 232 investigations began on Sept. 2.

Investigations cover:

• Imported robots & industrial machinery

• Imported PPE

• Medical consumables

• Medical equipment and devices

The investigation seeks detailed information about expected demand, U.S. domestic production capacity, and reliance on foreign supply chains.

Includes, but is not limited to:

- CNC machining centers

- Lathes

- Milling machines

- Grinding/deburring equipment

- Industrial stamping/pressing machinery

- Automatic tool changers, jigs, fixtures

- Cutting/welding/handling machine tools

- Metalworking machinery such as:

- Autoclaves

- Industrial ovens

- Metal finishing/processing tools

- EDM machinery

- Laser & waterjet cutting systems

Used in healthcare environments, including:

- Surgical masks

- N95 respirators

- Gloves

- Protective gowns

- Associated components

- Disposable or short-use medical items:

- Syringes, needles, infusion pumps, forceps, scalpels

- IV bags, catheters, tracheostomy tubes

- Anesthesia equipment

- Bandages, gauze

- Sutures

- Diagnostic/lab reagents

- Related components

Durable equipment supporting patient care:

- Wheelchairs, carts

- Crutches

- Hospital beds

Devices used for diagnosis, monitoring, or treatment:

- Pacemakers

- Insulin pumps

- Coronary stents

- Heart valves

- Hearing aids

- Robotic and non-robotic prosthetics

- Glucose monitors

- Orthopedic supports

- CT scanners, MRI machines

- Electrosurgical equipment

- X-ray/radiological equipment

- Ventilators

U.S. Lowers Tariff on EU Automobiles to 15%

On Sept. 24, the Trump administration published a formal notice implementing the U.S.–EU trade framework agreement, confirming a 15% tariff on EU-made cars and automotive products retroactive to Aug. 1.

Before the adjustment, European automakers faced the 15% baseline tariff plus an additional 25% industry tariff.

Compared with the previous 25%, the unified 15% rate is a substantial reduction — though still well above the pre-Trump-era 4.8% tariff.

EU Commission President Ursula von der Leyen stated that 15% is “the best Europe could secure.”

Under the July framework agreement, the U.S. now applies a 15% baseline tariff to most EU imports, including automobiles, pharmaceuticals, semiconductors, and lumber.

The U.S. also grants sector-specific exemptions for:

• Aircraft and parts

• Generic drugs and ingredients

• Certain metals and minerals

- Under the agreement:

- The EU will eliminate tariffs on all U.S. industrial goods.

- Provide preferential access for U.S. seafood and agricultural products.

- Commit to purchasing:

• $750 billion in U.S. LNG, oil, and nuclear products

• $40 billion in U.S. AI chips

- EU companies will invest $600 billion in U.S. strategic industries by 2028.

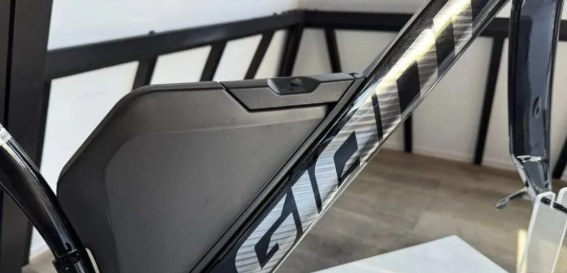

CBP Issues Withhold Release Order on Taiwan-Made Giant Bicycles

CBP found indicators of forced labor in Giant Manufacturing’s Taiwan operations, including:

- Abuse of vulnerability

- Abusive working/living conditions

- Debt bondage

- Withholding of wages

- Excessive overtime

A 2024 labor-practices investigation found:

- Giant frequently employed migrant workers in its Taiwan factories.

- Workers were recruited through labor brokers requiring thousands of dollars in fees, which were later deducted from workers’ wages.

CBP concluded Giant gained “unfair profit” through these practices, allowing its products to undercut U.S. and international competitors.

CBP has issued a Withhold Release Order (WRO) covering:

- Taiwan-made Giant bicycles

- Bicycle parts and components

- LIV and CADEX branded products

Under the WRO:

- All covered shipments will be detained at U.S. ports.

- Products may be returned to the exporter, destroyed upon request, or released only if compliance is proven.

- It is unclear whether the order applies to Giant-produced bicycles sold under other brands (e.g., Trek, Scott).

Giant stated it will appeal the decision.

The company said that as of January 2025, it implemented a Zero Recruitment Fee Policy, meaning all recruiting and government-related fees are paid by the company, not workers.

Giant added it uses third-party audits and internal controls to ensure labor safety and working conditions.

As tariff policies shift rapidly and supply chain risks escalate, a reliable and professional logistics partner is crucial.

With over 50 years of customs clearance experience and a fully self-operated Chinese–American clearance team, we specialize in:

- U.S. last-mile customs clearance & transfers

- Amazon FBA logistics

- One-stop 3PL warehousing solutions

Powered by our Los Angeles headquarters, SS Group is committed to providing secure, efficient, and compliant logistics solutions — helping your business stay resilient and navigate the complexities of global trade.

If you need assistance, feel free to contact us anytime.